when will capital gains tax rate increase

Most single people with investments will fall. Web 2022 federal capital gains tax rates.

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Web 2023 capital gains tax rates.

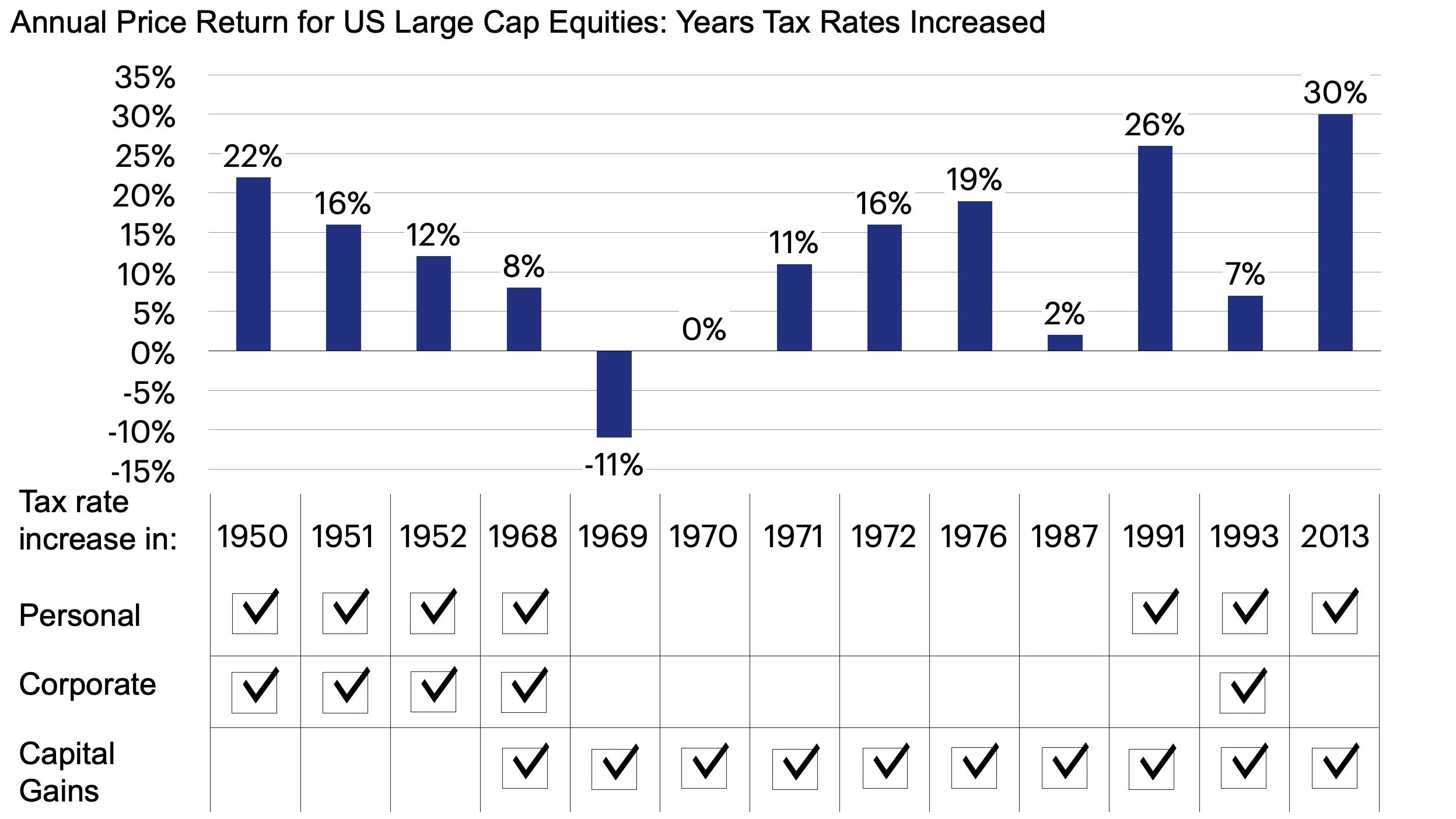

. Capital gains taxes on assets held for a year or. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Web Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

For example a single person with a total short-term capital. Tax filing status 0 rate 15 rate 20 rate. Web The higher your income is the more likely you are to face a higher capital gains tax rate after 2021 and the more it makes sense to consider options for any highly.

Web From 1954 to 1967 the maximum capital gains tax rate was 25. Web 4 rows The gains that you make from the selling of your capital assets which you held for at least one. Web April 23 2021.

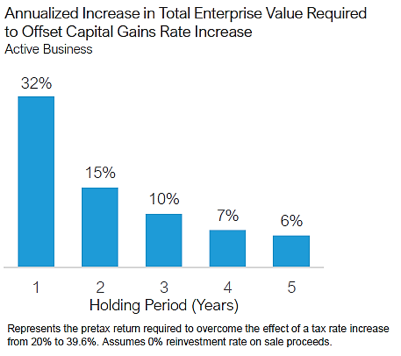

10 and 20 tax rates for individuals not including residential property and carried interest. Web The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Web President Bidens American Family Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to.

18 and 28 tax rates. Web For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. Web In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing.

Web Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Taxable income of up to 40400. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less.

President Joe Bidens American Families Plan will likely. Web Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized. Those with less income dont.

This means youll pay 30 in. That means you will be able to earn more money before the capital gains. Web Above that income level the rate jumps to 20 percent.

Web The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition. Web 2021 Long-Term Capital Gains Tax Rates. For instance the top.

Web The following Capital Gains Tax rates apply. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Just like income tax youll pay a tiered tax rate on your capital gains.

Web In 2023 the income thresholds for the 0 15 and 20 capital gains rates are increasing.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Capital Gains Full Report Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income

Dramatic Increase In Irs Capital Gains Transactions As Biden Administration Considers Raising Tax Rates On The Wealthy Marketwatch

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Managing Tax Rate Uncertainty Russell Investments

Some New Investors See A Buying Opportunity If Biden Raises Capital Gains Taxes Marketwatch

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

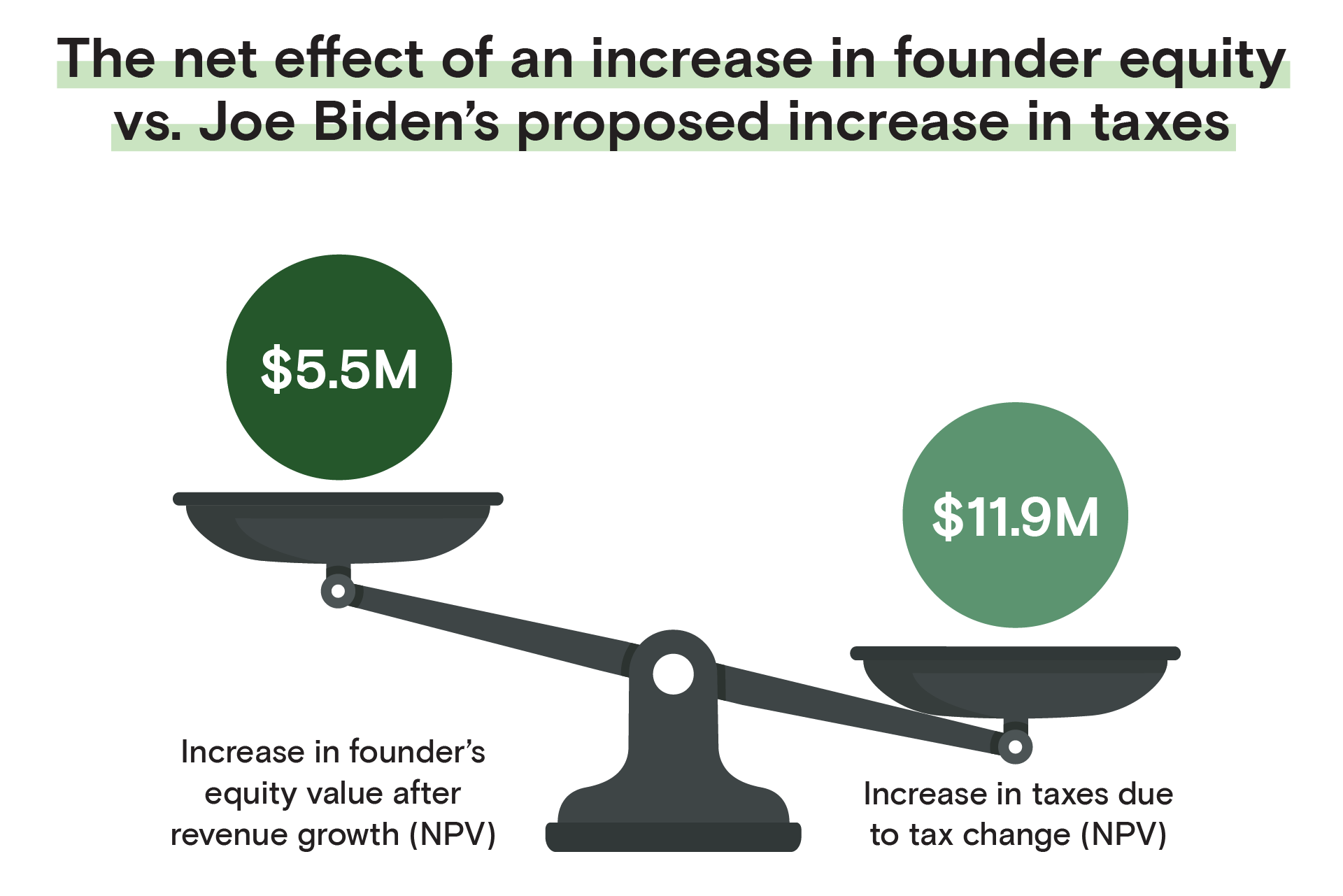

For Founders The Implications Of Joe Biden S Proposed Tax Code

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Will Tax Hikes Kill The Bull Market Invesco Us

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep